KCB Group Plc has secured conditional approval from the Competition Authority of Kenya (CAK) to acquire Riverbank Solutions Limited.

The green light comes with strict safeguards aimed at protecting third-party data and ensuring continuity of service for Riverbank’s existing clients.

Data Ring-Fencing Mandated

As part of the approval terms, CAK directed KCB to fully segregate all transactional, customer, and merchant data collected or processed through Riverbank’s platforms. This data must remain ring-fenced and cannot be accessed or used by KCB for any purpose beyond the operations of Riverbank itself. The condition is designed to prevent unauthorized access and uphold data privacy standards across the financial technology ecosystem.

The Authority also instructed both parties to ensure Riverbank continues servicing its customers under existing contractual terms. This move reinforces consumer protection and maintains operational integrity during the transition. By preserving service continuity, the regulator aims to minimize disruption and safeguard client trust as ownership shifts.

Strategic Expansion with Regulatory Oversight

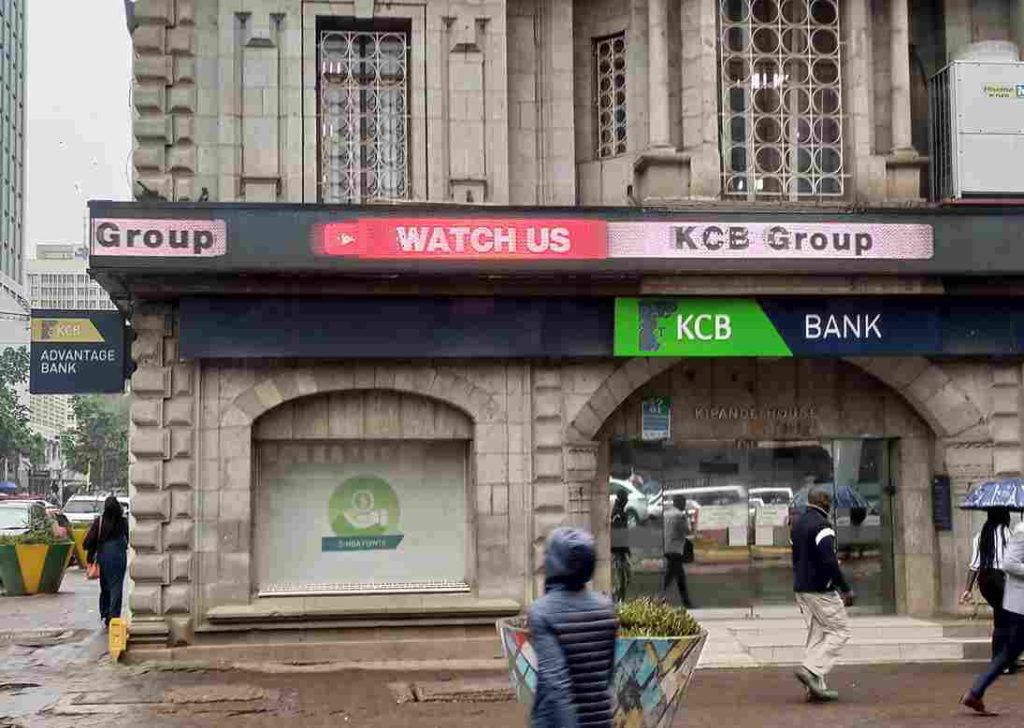

The acquisition marks a strategic expansion for KCB Group into digital payment infrastructure, while highlighting the regulator’s commitment to responsible consolidation in Kenya’s financial services sector.

The transaction was authorized under Section 46(6) of the Competition Act and formally announced on December 19, 2025.

KCB Group Eyes Strategic Stake in Pesapal to Deepen Digital Payments Ecosystem