Sycamore Capital, a digital-based investment platform, has become the 11th firm to exit the regulatory sandbox and receive approval from the Capital Market Authority (CMA) to operate as a collective investment scheme (CIS).

CISs are funds that invest in assets like bonds, equities, or cash and are run by fund managers.

“The Capital Markets Authority has announced the successful exit of Sycamore Capital Limited from the regulatory sandbox and approval to operate as a mobile-based collective investment scheme intermediary service platform provider through the Cashlet mobile application,” said the CMA.

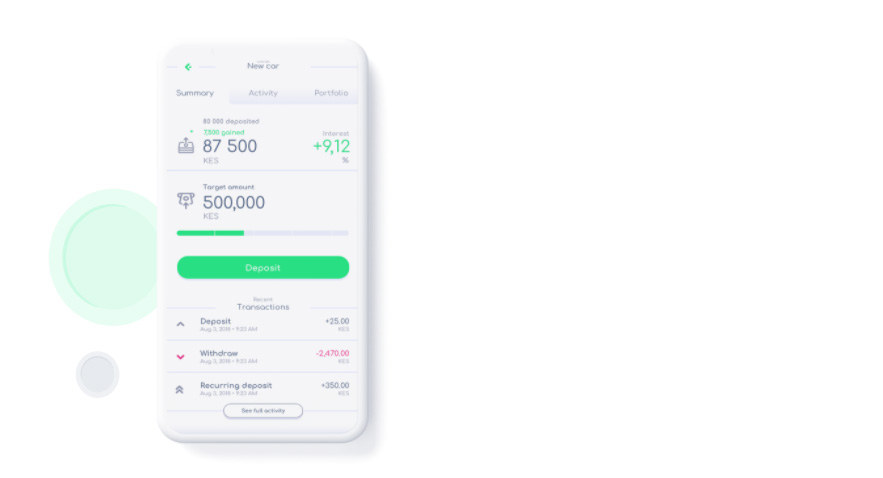

Sycamore Capital entered the CMA sandbox in July 2021 to test its Cashlet app, which allows retail investors to buy diversified stock packages and fixed-income investments like government debt paper.

The firm partnered with ICEA Lion Asset Managers, a licensed fund manager, to direct the investments of Cashlet users into registered CISs.

Wycliffe Shamiah, CMA chief executive, said that the regulatory sandbox is an important tool for developing evidence-based policy and regulation by facilitating innovation.

“The regulatory sandbox remains an important tool for the authority in developing evidence-based policy and regulation by facilitating innovation,” said Wycliffe Shamiah, CMA chief executive.

He added that the sandbox also helps to grow the investor base, democratise wealth, and enhance liquidity in the capital markets.

The regulatory sandbox is a platform that enables the live testing of innovative capital markets-related products, solutions, and services.

The Cashlet app aims to foster an investment culture among youth by offering convenient and low-cost access to unit trust schemes and reducing the need for traditional paperwork, which often discourages millennials from investing.