Stanbic Holdings launched its Sustainability Report 2022 showcasing its commitment to supporting its clients and the community in transitioning to a low-carbon and inclusive economy.

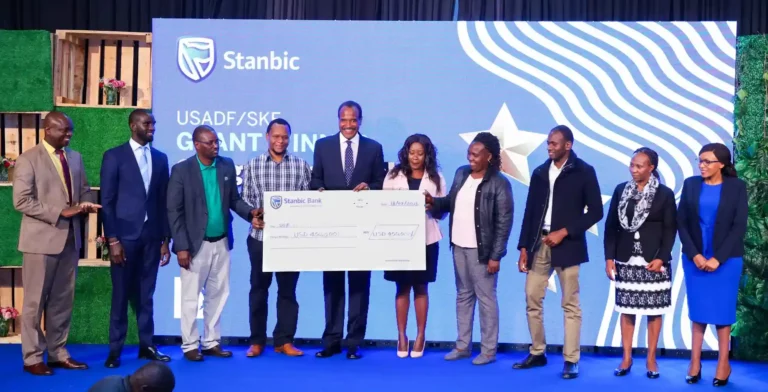

The report highlighted the bank’s initiatives in capacity building, partnerships and grants for education, health and entrepreneurship.

Dr. Joshua Oigara, Chief Executive Stanbic Kenya and South Sudan said at the launch that the bank’s strategic priorities are aligned with the social, economic and environmental (SEE) needs of its stakeholders.

He added that the bank is leveraging sustainable financing and strategic partnerships to deliver market-specific solutions that foster inclusion and growth.

Key highlights of the report

- Stanbic Bank increased its green financing portfolio in the past year, funding projects and solutions that positively impact the economy and the environment.

- The bank implemented frameworks and governance structures to ensure accountability and transparency in its operations.

- The bank set goals for the next 3 years, such as achieving 10% green financing of the total book by December 2023, allocating 30% of procurement spend to marginalized groups (women, youth, SMEs) by 2025, and establishing a climate risk framework by August 2023.

William Khamasi, Stanbic Head of Sustainability, said the bank is deploying tools, systems and capabilities to drive sustainability, mitigate risk and create value for its clients, partners, shareholders and community.

“Climate change remains a key focus area and we will continue to work with our stakeholders to support green projects and the blue economy,’ he said.