Global food prices rose in April for the first time in a year driven by a “steep increase” in sugar prices, as well as increased costs for meat and rice, according to the United Nations’ food agency.

The FAO Food Price Index, which tracks monthly changes in the international prices of commonly-traded food commodities, averaged 127.2 points in April 2023, up 0.6 per cent from March.

At that level, the Index was 19.7 per cent below its level in April 2022, but still 5.2 per cent higher than in April 2021.

“The FAO Sugar Price Index averaged 157.6 points in May, up 8.2 points (5.5 per cent) from April, marking the fourth consecutive monthly increase, and as much as 37.3 points (30.9 per cent) above its value a year ago,” FAO noted, the highest level since October 2011.

*****

In Kenya, the price of sugar recorded the highest increase of 22 per cent in May, according to the Kenya National Bureau of Statistics (KNBS).

The price of sugar rose from an average of Ksh 159 in April to Ksh 194.29 in May.

In April, the average price of sugar stood at KSh159 an increase of Ksh3 from the average of KSh156.18 recorded in March.

The sudden surge in price has placed a heavy financial burden on consumers, with the cost of sugar doubling within a week.

A recent spot check conducted at various retail supermarkets in Nairobi highlights the steep increase in sugar prices.

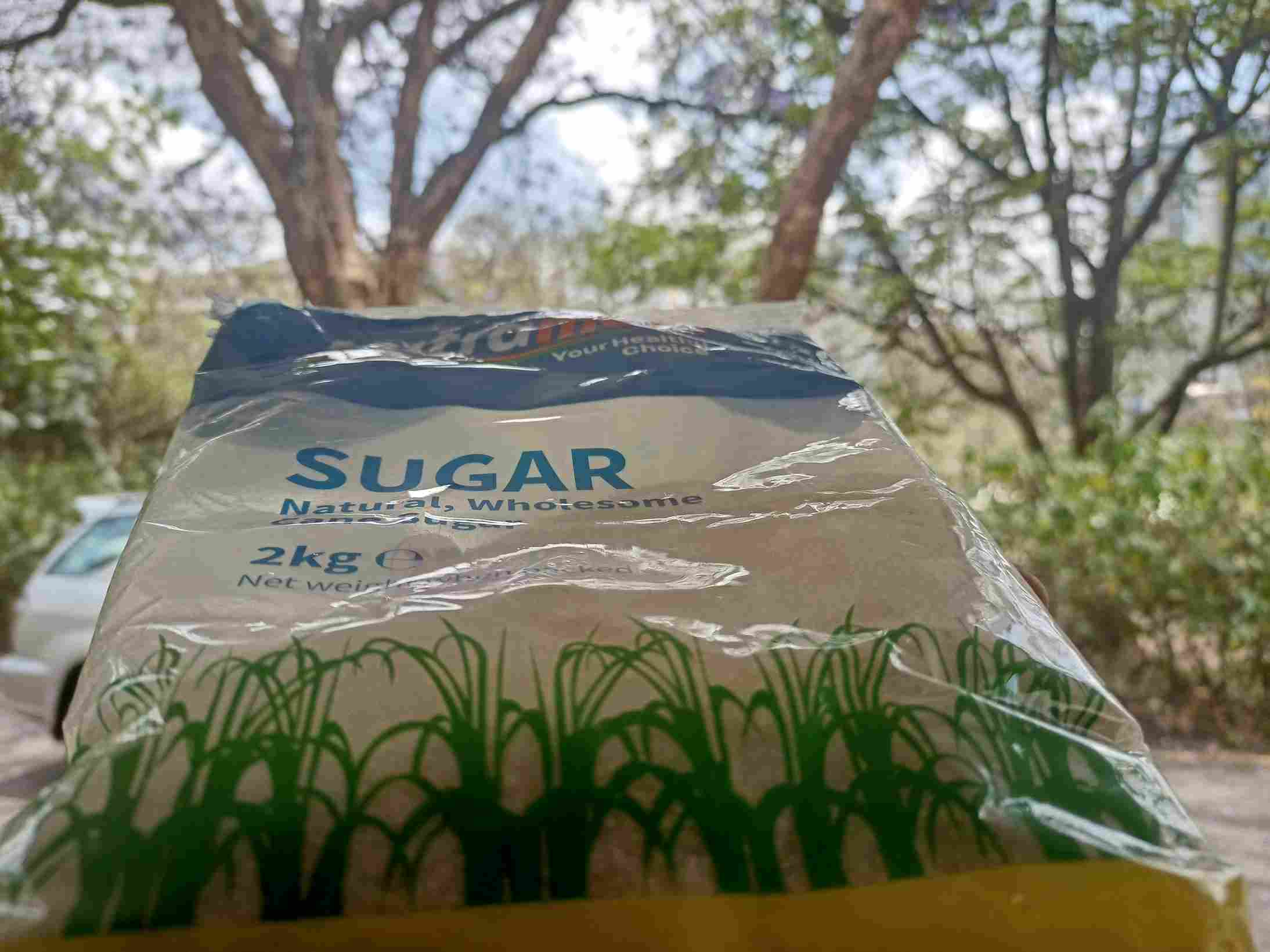

A kilogram of sugar currently ranges from KSh189 to KSh210, while a 2kg packet is between KSh419 and KSh440, depending on the brand.

Naivas supermarket is selling Mara white brand sugar at KSh189 per kilo, and their own Naivas branded white sugar at KSh350 per 2kg packet, with a maximum purchase limit of two packets per customer.

QuickMart supermarket is retailing brown QuickMart branded sugar at KSh365 per two-kilo, Kabras at KSh420 for a two-kilo packet, and Mumias sugar at KSh185 for a one-kilo packet.

Sugarcane shortage

The shortage of sugarcane is a primary factor contributing to the current sugar crisis.

Data from the Sugar Directorate reveals a significant drop in sugarcane production, with a 22 per cent decrease recorded between January and February.

“Total sugarcane milled by sugar factories dropped to 405, 389 metric tonnes in April 2023, down from 546,150 metric tonnes in March 2023 and 716,274 metric tonnes in February 2023,” the Directorate said.

“Sugar made, therefore, also decreased to 32, 729 metric tonnes from 49,372 metric tonnes in March. Total sugar produced in April 2023 was 31,970 metric tonnes, a 36 per cent decrease from the previous month’s total of 49,761 metric tonnes.”

This decline is being attributed to various factors, including the inability of millers to provide farmers with essential inputs such as fertilizers and chemicals, resulting in a staggering 60 per cent reduction in cane production.

Moreover, millers’ financial constraints have further hampered their ability to support farmers adequately.

I said so a few weeks ago. Today the @CBKKenya also reinforced. Sugar in Kenya cc @MwangoCapital @SeweS_ https://t.co/1Fxmn3kRP7 pic.twitter.com/MIfIkVfHUM

— David Indeje 🇰🇪 ( He/Him/His) (@David_Indeje) May 31, 2023

Consequently, the Central Bank of Kenya Governor, Dr Patrick Njoroge said they are unable to contain the surge through monetary policy intervention.

“Inflation has been coming down, but the real spanner in the works was sugar. You cannot control the price of sugar using monetary policy. Only the second-round effects will do that. At the same time, we have food prices coming down quite sharply,” Dr Njoroge said in the post-MPC briefing.

“In line with the MPC, we project local commodity prices, especially vegetables to continue moderating downwards, a fall in global palm oil prices (40% YoY) and wheat (35% YoY) to reflect on local shop prices in June,” said NCBA Bank Analysts in the post-MPC brief.

“However, their contribution to the total inflation rate is low-weighted at 1.49 per cent for cooking fat and oil and 2.07 per cent for wheat flour and bread, respectively. Additionally, the April 2023 IHS Markit

PMI data indicate a general fall in input and output prices recorded by the manufacturers.”

Government intervention

To alleviate the sugar shortage, the government implemented measures to allow duty-free imports.

In December 2022, a total of 100,000 metric tonnes of brown or white sugar were permitted for importation.

Additionally, the Kenya National Trading Corporation (KNTC) was authorised to import 200,000 tonnes of sugar duty-free in February 2023.

However, despite these efforts, the market has not stabilised, leading to continued price increases.

In addition to the shortage, concerns have been raised by the Kenya Association of Manufacturers (KAM) regarding the Finance Bill 2023 on 28th April 2023.

The Bill seeks to amend laws relating to various taxes and duties such as the Income Tax Act, Value Added Act (VAT), Tax Procedures Act and Excise Duty Act while proposing new taxes, regulations, and incentives.

According to KAM, the proposal to charge an excise tax (Ksh 5 per kg) on sugar will lead to an increase in the price of sugar.

“Additionally, imposing excise duty on sugar will make the products manufactured using sugar uncompetitive because other EAC states do not impose excise duty on sugar,” KAM says.

Consequently, it has reservations about the proposal to impose excise duty ( Ksh42.1 per kg) on locally manufactured confectionery.

The lobby group says if implemented, it “will drive several local companies out of business as it will make them uncompetitive and their products unaffordable.”

“This move will eliminate the competitiveness of the local confectionary industry against imports as the retail prices will increase due to the excise duty cost that will be passed on to the consumers.”