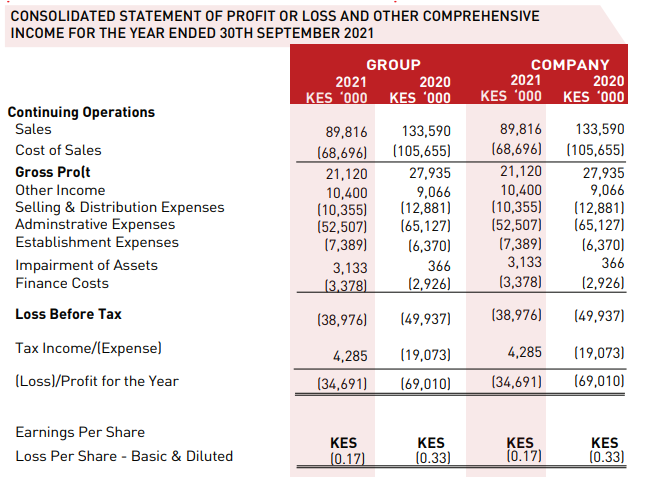

Eveready East Africa reported a KSh 34.7 Million loss for the year ended September 30th 2021 compared to a net loss of KSh 69 Million over a similar period in 2020.

The company said this was a 49 per cent improvement in the delayed financial results.

It also disclosed that it witnessed a 33 per cent decrease in revenue due to lower sales numbers during the period principally because of the Covid-19 pandemic which impacted the firm’s customers and its supply chain and route to market in the period.

“We adopted strict cost-saving measures in response to the pandemic which resulted to 17 per cent reduction in overhead costs,” said the firm in a statement signed by the Board Chairperson Lucy Waithaka and Thomas Masaki, Acting Managing Director, Eveready Group.

The Board of Directors of Eveready East Africa Plc do not recommend the payment of a dividend.

The listed battery distributor operates in three segments automotive, lighting and household.

The Company sells its products in Kenya primarily through automotive dealers, hypermarkets, wholesalers, electronic stores, institutions, retail stores, petrol stations, high-frequency stores, and e-commerce. Going forward it maintains that the Covid-19 pandemic remains a ‘concern’.

“Though the core capital has been eroded over time; the Company shall continue engaging its key stakeholders on initiatives to place it on a path to sustainable recovery.”

It plans to hold its 55th Annual General Meeting (AGM) of Eveready East Africa Plc virtually on Friday, 4th March 2022 at 2.30 p.m.

Khusoko is now on Telegram. Click here to join our channel and stay updated with the latest East African business news and updates.