Growth prospects and investments for Kenya’s insurance industry will largely be influenced by the ongoing regulatory changes and improve the level of penetration, Cytonn Investments say.

The Central bank of Kenya’s September 2021 Financial stability report found out that insurance uptake in the country remains low compared to other key economies with the insurance penetration at 2.3% as at December 2020.

This is below the global average of 7.4%, attributable to the fact that insurance is still seen as a luxury and mostly taken when it is necessary or a regulatory requirement.

Cytonn Investments however, say that regulatory changes will impact the sector positively in line with international best practices.

“Regulatory trends in the Insurance sector will very much determine growth and investments prospects. Newer minimum capital requirements are expected to set off mergers and acquisitions in the sector, with many insurers failing to meet the minimum,” Cytonn Investments says in its H1’2021 Kenya Listed Insurance Sector Report themed “Improved Earnings In A Higher Loss Ratio Environment’’.

“The regulatory reforms also present an opportunity to international firms to enter into the Kenyan market, given it has strong economic growth prospects.”

Regulations used for the insurance sector in Kenya include the Insurance Act cap 487 and its accompanying schedule and regulations, Retirement Benefits Act CAP 197 and The Companies Act.

Their sentiments, collaborates with Gauri Shah, Associate Director leading PwC’s Actuarial practice for the East Market area who said Innovation and consolidation, coupled with global best practice in regulatory compliance, will make the sector more attractive to investors.

For instance, Cytonn says new compliance requirements as stipulated in IFRS 17 come at a high implementation cost but they also assist companies manage their risks and capital in a better way.

“The concerted push by the regulator to have the desired capital adequacy levels will likely see increased consolidation,” says Cytonn which will enable the insurers price risk appropriately rather than conduct price wars.

Due to the pandemic, the International Accounting Standards Board (IASB) deferred its implementation to be effective from January 2023 or earlier.

In Kenya, general insurance business remains the largest contributor to industry insurance activity contributing 59.3% of the total premium. Motor insurance and medical insurance classes of business account for 62.3% of the gross premium income under the general insurance business.

According to H1’2021 data, Kenya had 56 insurance companies, 5 reinsurance companies, 220 insurance brokers and 10,522 insurance agents (which includes 26 Bancassurance agents).

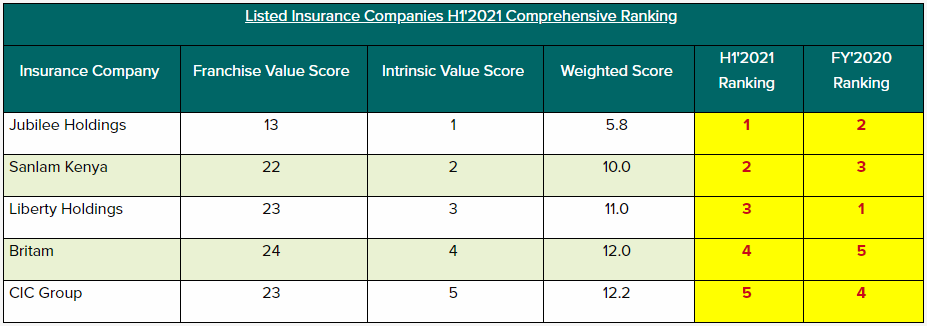

Cytonn H1’2021 Insurance Report, ranked listed insurance firms from a franchise value and from a future growth opportunity perspective with the former getting a weight of 40.0% and the latter a weight of 60.0%.

For the franchise value score, they included the earnings and growth metrics as well as the operating metrics.

Major Changes from the H1’2021 Ranking are:

- Jubilee Holdings improved to position 1 in H1’2021 from position 2 in FY’2020 mainly due to the improvement in the franchise score in H1’2021, driven by reduction in expense ratio to 30.4% in H1’2021, from 56.3% in FY’2020. As a result, the combined ratio also declined to 140.0% in H1’2021, from 157.6% in FY’2020,

- Sanlam improved to position 2 in H1’2021 from position 3 in FY’2020 mainly due to an improvement in its intrinsic value score wherein it recorded an upside of 4.0% on its share price of Kshs 11.5 as of 11th November 2021, outperforming Liberty, Britam and CIC Group.

- Liberty declined to position 3 in H1’2021 from position 1 in FY’2020 mainly due to declines in both the franchise and intrinsic value scores.

- Britam Holdings improved to position 4 in H1’2021 from position 5 in FY’2020 mainly due to the improvement in the franchise score in H1’2021, driven by reduction in loss ratio to 78.5% in H1’2021, from 85.7% in FY’2020.

- CIC Group declined to position 5 in H1’2021, from position 4 in FY’2020, on the back of a weaker franchise score driven by deterioration of its loss ratio to 81.3% in H1’2021, from 71.4% in FY’2020, and combined ratio to 132.1% in H1’2021, from 121.5% in FY’2020.

1 Comment

Pingback: Equity Bank Kenya Gets Licence to Commence Insurance Business