The Co-operative Bank of Kenya on Wednesday posted a net profit of KSh7.4 billion for the first six months of the year ended June 2021 from KSh 7.2 billion in the same period last year.

This was boosted by growth in interest and non-interest income, however, its high bad loan provisions doubled in the period.

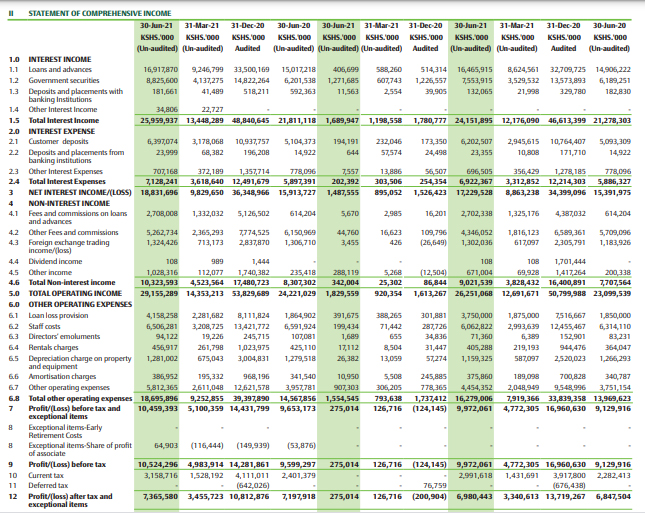

According to the lenders’ un-audited results of the Group and the Bank for the Period ended 30 June 2021, its net interest income grew by 18 per cent to KSh18.8 billion.

Its loan loss provision doubled to KSh 25.5 Billion at the end of H1, 2021, compared to KSh 13.1 Billion over a similar period last year.

“The Group prudentially increased loan loss provisions to KSh4.2 billion in appreciation of the challenges that businesses and households continue to face due to the economic effects of the ongoing pandemic,” Gideon Muriuki, the chief executive said.

On the other hand, Co-op’s subsidiaries posted improved results, with the 90 per cent-owned Kingdom Bank returning Sh275 million net profit. It had booked a KSh200.9 million loss in the full year to December.

Co-op Consultancy and Insurance Agency returned KSh433.8 million pre-tax profit on increased bancassurance business.

Co-op Trust Investment Services returned KSh47.9 million as funds under management rose by KSh59.1 billion.

Its Co-operative Bank of South Sudan recorded a loss of KSh290 million due to hyperinflation accounting following the South Sudanese pound devaluation.

Analysts’ Commentary

We recommend a long term buy recommendation with a target price of Ksh16.16.

Its recent acquisition, Kingdom Bank Limited, emerged from its loss-making position in FY20 to generate a profit of Ksh 275.0 million in 1H21.

The Group also launched its pension-backed mortgages in July 2021, the first in the market. This product is expected to boost homeownership for the over 3.0 million pension contributors in Kenya as well as diversify the Group’s income.

Additionally, its E-Credit offering is viewed as low risk as it is based on salary checkoff and it is anticipated that asset quality will improve as the affected sectors recover.

Genghis Capital