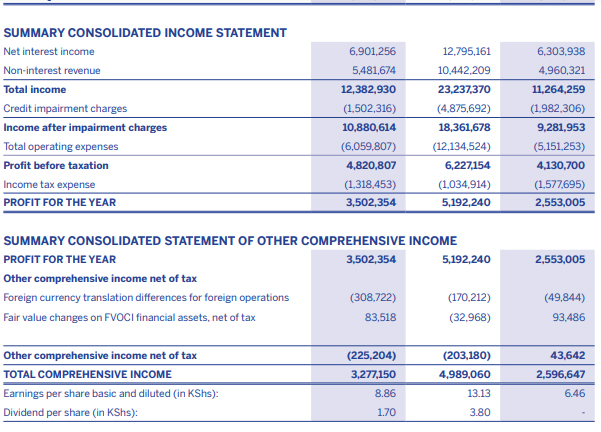

Stanbic Holdings bank reported that its half-year profit rose by 34.6 per cent to Ksh 3.5 billion from Ksh 2.6 billion during a similar period last year attributed to improved operating income and lower credit impairment charge.

Chief Finance Officer, Mr Abraham Ongenge said, “The bank’s profit after tax was supported by double-digit revenue growth and improved credit losses.”

Net interest earnings grew by 9% to Ksh 6.9 billion on account of loan book growth and improved margins.

The lender’s credit impairment charges during the period were down 15 per cent at Ksh 1.5 billion from Ksh2 billion during the comparable stage last year.

Stanbic Bank Kenya Chief Executive, Mr. Charles Mudiwa said, “We started the year by repositioning our brand through a message of hope dubbed, ‘It Can be’. This message speaks to the commitment and support that drive us to deliver on our promise. We have realigned our strategy to focus more on our customer needs through our client-centricity value proposition and providing innovative solutions that are empowering and blend in with their lifestyle.”

Stanbic Holdings Board of Directors has recommended an interim dividend of Ksh 1.70 for each ordinary share of KShs 5 on the issued and paid-up share capital of the Company.

This will be payable to shareholders on the book closure date, 6 September 2021.