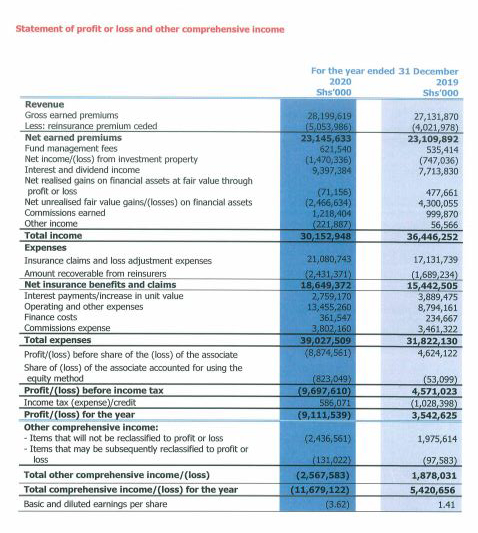

Britam Holdings, a diversified financial services company, on Wednesday, reported a pre tax profit of Ksh 9.7 billion for the year ended 31 December 2020.

This is compared to Ksh 4.6 billion in 2019.

“Of this loss, Ksh 2.3 billion related to a fair valuation loss due to poor equities performance and Ksh 2.0 billion related to property impairments,” the firm said in a statement.

“The results were further depressed by a provision for investment losses of Sh5.2 billion in Wealth Fund Management Fund LLP, a fund managed by Britam Asset Managers which is a fully owned subsidiary of Britam Holdings Plc,” the Nairobi Securities Exchange-listed firm said in a statement.

It also blamed the unfavourable operating environment adversely impacted their investments in HF Group resulting in a group share loss of Ksh 823 million and a reduction in the value of the investment by Ksh 603. Britam Holdings mulls at selling part of its 48.2 per cent stake in HF Group.

On the other hand, its core insurance business remained resilient in the review period.

“However, operating results were better than 2019. Our gross earned premiums (GEP) and fund management fees was up 4.2 per cent to KSh28.8 billion from KSh27.7 billion,” the insurer said.

This was attributed to the growth of our insurance revenues especially the international general insurance business which recorded an increase in GEP of 50 per cent, contributing 28 per cent of the group’s GEP and a profit before tax of KSh832 million up from KSh38 million in 2019.

The Board did not recommend the payment of a dividend. in 2019, it paid out a dividend of Sh 25 cents per share totalling Ksh 630,870,00.