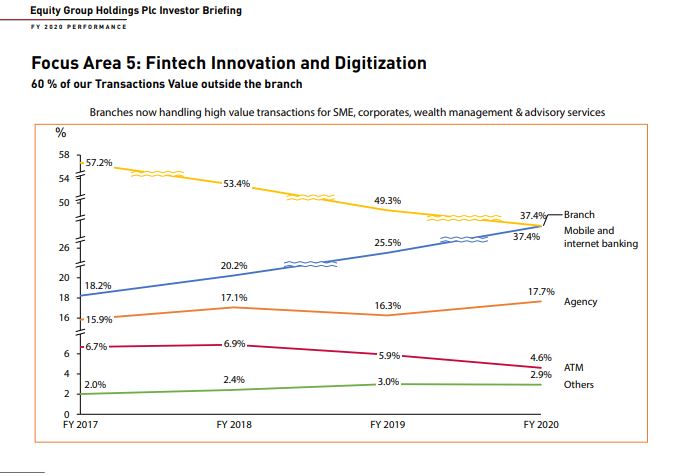

Kenya’s Equity Group Holdings has seen an increase in the number transactions happening at its alternative channels accounting for over 62.6 per cent in value.

Transaction value within its branches, accounting for only 37.4 per cent.

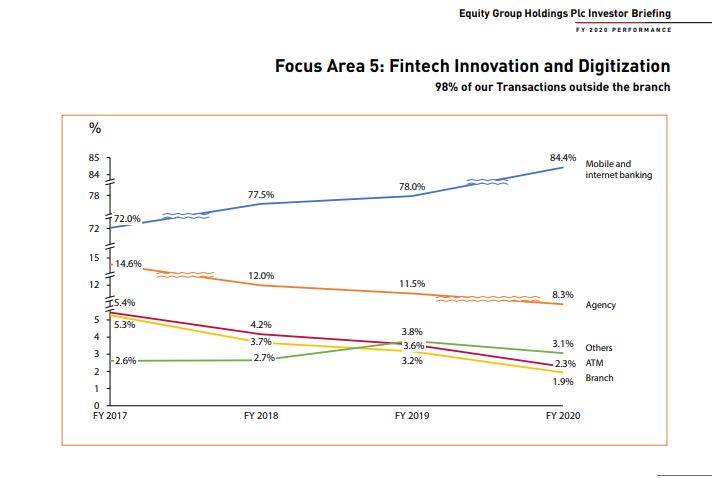

According to data from the Bank’s full-year 2020 financial results, digitization enabled 98 per cent of all the Group transactions to happen outside the branches with 85 per cent of the transactions being on self-service mobile and Internet banking and 12 per cent of the transactions happening on Agency and Merchant banking third party variable cost infrastructure.

“Adoption of digital payments was accelerated with the number of transactions processed over the Pay with Equity solutions growing by 31 per cent and the value of the transactions growing by 58 per cent to reach Kshs 2 trillion up from Kshs 1.3 trillion,” Equity Group Holdings Fully Year 2020 investor report records.

The report further attributed the increased adoption to continued efforts by the bank to transform itself into a low-cost operating business model, by enabling self-service capabilities for customers and transforming the banking experience from the place you go, to something you do on the device.

During the review period, only 3% of the bank’s transactions happened on fixed cost brick and mortar branch and ATM infrastructure.

At the same time, 97% of the loan transactions were conducted on the mobile channel delivering unparalleled convenience to borrowers, round the clock banking that compresses geography and time to allow whatever time, wherever location banking experience. This shows how ‘easy it is for customers and the general public to access Equity Bank loans from their mobile devices through platforms such as Eazzy App, Equitel, Eazzy Net and *247#.