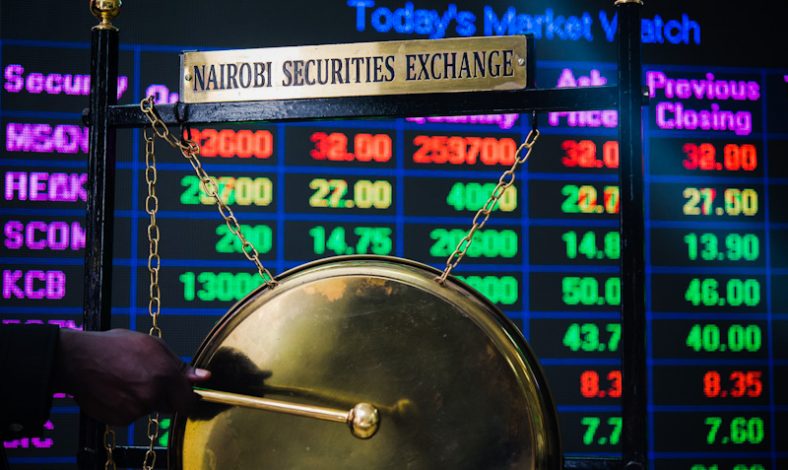

Foreign investors were bearish on Nairobi Securities Exchange (NSE) offloading their stakes on Safaricom and Equity Group, according to Genghis Capital.

Investors opted to accumulate KCB Group and East African Breweries Limited accounting for 72.9% of the week’s turnover.

During the week, they had a net selling position of USD 9.1 million, from a net buying position of USD 4.4 million recorded the previous week.

The equities market was on a downward trajectory with NASI, NSE 20 and NSE 25 losing by 3.5%, 2.0% and 2.9%, respectively, driven by losses recorded by large-cap stocks such as Cooperative Bank, EABL and Equity Group of 12.1%, 5.8%, and 4.8%, respectively.

The losses were however mitigated by gains recorded by NCBA Group, which gained by 9.7%.

In Q1’2021, the equities market recorded a mixed performance, with NASI and NSE 25 gaining by 4.3% and 3.4%, respectively, while NSE 20 declined by 1.2%.

“The equities market performance during the quarter was driven by gains recorded by large caps such as BAT Kenya, KCB Group, Safaricom, and Co-operative Bank of 31.6%, 8.4%, 5.8% and 5.6%, respectively,” Cytonn Investments says.

The gains were weighed down by losses recorded by stocks such as Diamond Trust Bank (DTB-K), ABSA Bank and NCBA Group of 16.3%, 8.7% and 6.0%, respectively.

Equities turnover increased by 15.2% during the quarter to USD 288.5 mn, from USD 250.5 mn in Q4’2020. Foreign investors remained net sellers during the quarter with a net selling position of USD 8.9 mn, from a net selling position of USD 24.5 recorded in Q4’2020.

The NSE maintains four market listing categories, namely, the Main Investment Market Segment, Alternate Investment Market Segment, Fixed Income Securities Market Segment, and Growth Enterprises Market Segment.