Kenya’s financial system remains sound albeit potential negative effects of Covid-19 pandemic on assets quality and overall performance metrics, the Central Bank said in a new report.

The Kenya Financial Stability Report, Issue No 11, published by Central Bank of Kenya, Capital Markets Authority, Insurance Regulatory Authority, and Sacco Societies Regulatory Authority, will, however, depend on the pandemic’s intensity and duration.

“Overall, the banking industry has sufficient capital buffers to withstand the COVID-19 pandemic shock, supported by the mitigation measures put in place by the Government and financial institutions,” the report reads.

The Kenya Banking Sector Charter of 2019 entrenches a responsibility and discipline in the banking industry plays a key role in the banking sector to be resilient.

The Banking Sector Charter is anchored on the adoption of customer-centric business models, risk-based credit-pricing, and ethical banking.

The resilience of the industry is also reflected in the high capital levels in relation to assets. As of June of 2020, the Core Capital to Total Risk-Weighted Assets (TRWA) and Total Capital to TRWA ratios was 16.4% and 18.5%, above the minimum regulatory requirements of 10.5% and 14.5%, respectively.

However, the Covid-19 pandemic eroded the banks’ assets quality gains made in 2019 as shown by the increased Non-Performing Loans (NPLs).

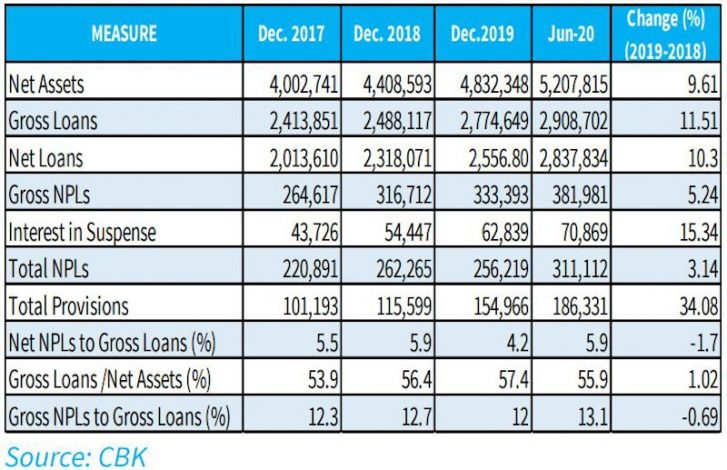

The ratio of gross NPLs to gross loans deteriorated to 13.1 percent in June 2020 from 12.0 percent in 2019, reflecting worsening households’ livelihoods and business closures, staff lay-offs due to disruptions in supply chains, restrictions of movements and lockdowns.

The gross NPLs increased by 14.6 percent in the first half of 2020 to KSh 381.98 billion in June 2020, indicating elevated credit risk.

The banks’ asset quality deterioration was not uniform across banks due to differences in business models and management’s attitude towards risk.

Banks in the medium peer group were the main drivers of high Gross NPLs ratio from June 2019 compared to banks in small and large groups.

The report discloses that the industry has enjoyed ample liquidity overtime, averaging way above the minimum regulatory requirement of 20 percent.

However, if long term government bonds are excluded from liquid assets, the liquidity ratio shrinks to 26.5 percent in December 2019 and 27.1 percent in June 2020.

Government securities are therefore a significant component of banks’ liquidity and therefore a change in their treatment, in computing liquidity ratios, will significantly affect banks’ liquidity buffers.

Liquidity conditions and distribution is key to the banking industry stability, signifying the bank’s ability to fund assets, and meet obligations as they fall due.

A liquidity problem in one bank can disrupt liquidity distribution in the entire banking industry due to the interconnected operations. The liquidity problem may also metamorphose into a solvency problem for a bank if not handled well.

The Financial Stability Report is published once a year and contains the Regulators’ assessment of the financial system stability in compliance with the Central Bank of Kenya Act, Section 4(2) and the Financial Sector Regulators Memorandum of Understanding (MOU).

The MOU establishes a Forum comprising of the CMA, CBK, IRA, RBA, and Sacco SASRA.

The National Treasury and Planning, Ministry of Trade, Industry and Cooperatives, and the Kenya Deposit Insurance Corporation (KDIC) have observer or associate membership status.