Trading at the Nairobi Securities Exchange (NSE) remains depressed due to the cautious stance being taken by investors says Genghis Capital.

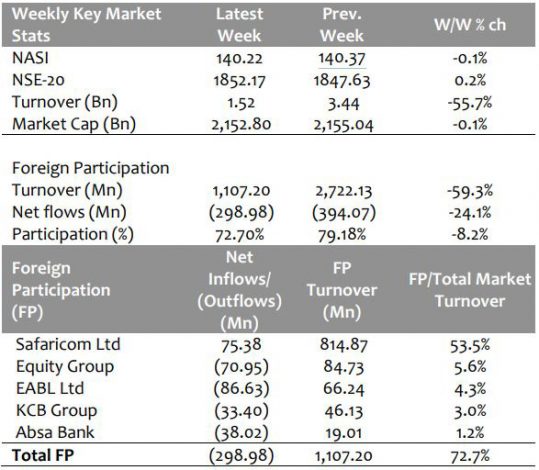

During the week ending Oct 2., the market recorded mixed performances, with NSE 20 recording marginal gains of 0.3 performance while NASI declined by 0.1 percent.

The NSE 25 on the other hand, remained unchanged from the previous week.

NASI performance was driven by losses recorded by large-cap stocks such as ABSA, EABL and Co-operative Bank, which declined by 2.0 percent, 1.8 percent and 1.7 percent, respectively.

“The decline was however mitigated by gains recorded by other large-cap stocks such as Diamond Trust Bank and Standard Chartered Bank of 2.1 percent and 0.8 percent, respectively,” noted Cytonn Investments in their weekly review.

Genghis Capital observed that foreigners were net sellers during the week, fairly trading in/out of the top stocks as opposed to previous large trades on Safaricom only.

“We expect the market’s cautiousness to persist in the coming week as investors assess their fourth-quarter investment strategies,” says Genghis.