House prices in Nairobi declined by 2.9 percent during the first half of 2020 compared to a decline of 1.8 percent in the first half of 2019 according to Knight Frank Pan-Africa Residential and Office Dashboards.

The latest data pushed the annual decline to 5.1 percent in the year to June mainly attributed to the continued oversupply of residential developments, unfavourable economic climate, low liquidity and expatriates returning to their home countries.

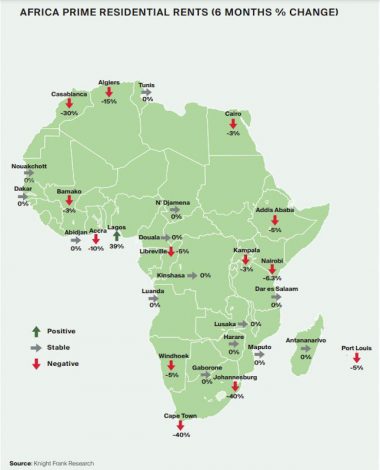

The report also tracked performance and trends in 29 African cities during the Covid–19 pandemic.

Prime residential rents also declined over the review period by 6.55 percent compared to 1.67 percent over a similar period in 2019, taking the annual decline to 7.62 percent in the year to June.

“We expect prime residential rents to decline in the second half of 2020 due to the projected negative economic growth, tighter liquidity, continued relocation of expatriates and less disposable income from potential tenants. Prime residential prices are also expected to decline albeit at a slower rate,” said Tilda Mwai, a researcher for Knight Frank Researcher Africa.

READ

Lagos, Nigeria recorded the highest increase in prime residential rents, a 38 percent increase from the fourth quarter (Q4) of 2019 attributed to the need for quality living spaces due to remote working offered by prime residential real estate.

In Kampala Uganda, downward pressure on rents was not witnessed. However, liquidity pressure on occupiers has in turn led them to request for lease concessions reference to rent repayment or abatement of their contractual obligations.

Of the 29 African cities tracked by Knight Frank, 60 percent recorded stable or increased rents over the first half of the year.

The Residential Dashboard also forecasts that in the short to medium term, there may be a reduction in residential demand.

“There has been a surge in the exit of expatriates from the continent due to pre-existing economic challenges, but enforced by the Covid-19 pandemic, which has resulted in subdued demand in the prime residential sector,” notes Tilda.

RELATED