Demand for apartments in Kenya accelerated in the second quarter as home buyers opted for cheaper houses.

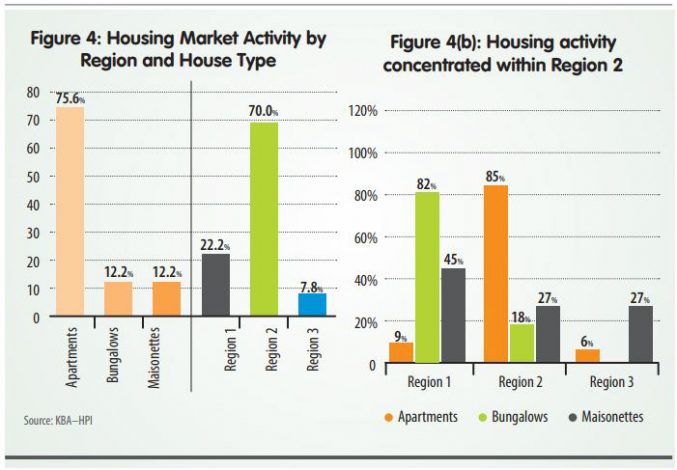

Kenya Bankers Association’s (KBA) Housing Price Index for the quarter showed that demand for apartments more than doubled accounting for 75.6 percent compared to 33 percent of the concluded sales in quarter one.

Subsequently, bungalows and Maisonettes jointly accounted for 24.4 percent of the concluded sales compared to 12 percent and 10 percent respectively in quarter one.

“A rise in both the demand for apartments and bungalows and a decline in Maisonettes is suggestive of a market leaning more in search for affordability among home buyers,” the report stated.

The Index notes that house price in the second quarter of 2020 remained largely stable and similar to previous quarters with plinth area, number of bedrooms, bathrooms, and region house is located playing a significant role.

During the period under review, KBA noted that “Despite being on the negative side, the growth of house prices points to a stabilising market with the outlook broadly reflecting the prevailing economic challenges.”

Knight Frank’s Half Year 2020 report, also found out that prime residential prices in Nairobi decreased by 2.9 percent over the first half of 2020 compared to a decline of 1.8 percent in the first half of 2019, pushing the annual decline to 5.1 percent in the year to June.

“The decline in both prime residential rents and prices is mainly attributed to the continued oversupply of residential developments, unfavourable economic climate, low liquidity and expatriates returning to their home countries.

Additionally, due to Covid-19, fewer transactions were finalised as a result of land registries being closed, and potential buyers opting to postpone land purchases.”

READ