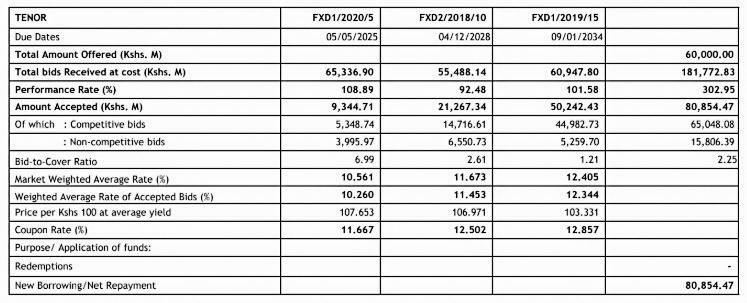

The Central Bank of Kenya says it received bids worth KSh 181.8 Billion for the re-opened 5, 10, and 15-year Treasury Bonds.

Treasury’s three (reopened) bonds -(FXD1/2020/05, FXD2/2018/10, and FXD1/2019/15)- that were auctioned on Wednesday to raise Ksh 60.00 billion was oversubscribed by 302.95 percent, according to theCentral Bank of Kenya.

This suggests that investors still see Kenya’s government bonds as a safe-haven asset, and the Treasury is not struggling to borrow despite the coronavirus crisis.

“The current low-interest-rate environment provides an opportunity for low-cost local debt financing. Meanwhile, the ample liquidity in the market, as well as preference for government securities, provides a favorable debt absorption landscape,” says NCBA Research.

The CBK had offered KSh 60 Billion worth of treasury bonds and accepted bids worth KSh 80.9 Billion. However, only Ksh 65 Billion were competitive bids compared to KSh 15.8 Billion that was made up of non-competitive bids.

The bonds will be listed on the Nairobi Securities Exchange with secondary trading in multiples of KSh 50,000.00 to commence on Tuesday, 28th July 2020.

CBK’s prospectus says the discount/interest is subject to withholding tax at a rate of 15 percent for the 5-year and 10 percent for the 10 and 15-year.

The bonds redemption dates are Five years -05/05/2025, Ten year – 04/12/2028 and Fifteen year-09/01/2034.

According to NCBA Bank Research, the auction was used “likely to serve as a benchmark and thus play a significant role for future bond issues taking into consideration the various investment horizons under the current uncertain landscape.”

****

“While this was expected, the magnitude of the oversubscription caught me by surprise with the CBK receiving more than three times the Ksh 60 billion it was looking to raise.

The weighted average of accepted bids falls below the current Nairobi Securities Exchange (NSE) yield curve. Analysts predict a further decline for the next twelve months as the CBK takes advantage of the high demand to lower the average cost of borrowing for the Government,” says Renaldo D’Souza, Head Of Research at Sterling Capital Limited.