- Banks opt for short term gains

- Kenya’s total Public Debt rose to KSh 6.6 Trillion at the end of May

The demand for shorter assets amid abundant liquidity in the market continues to drive yields lower due to the uncertainty regarding Kenya’s economic outlook.

“The Treasury bills auction of July 16 received bids totaling KSh 65.2 billion against an advertised amount of KSh 24.0 billion, representing a performance of 271.5 percent. Interest rates on all the Treasury bills tenors decreased,” says the Central Bank of Kenya.

During the week, 91-day paper registered the highest subscription at 746.9 percent, down from 948.1 percent recorded the previous week.

The subscription for the 182-day paper declined to 107.8 percent from 273.7 percent recorded the previous week, while the subscription of the 364-day paper increased to 245.1 percent from 206.7 percent recorded the previous week.

On the other hand, the average interbank rate stood at 1.8 percent from 1.9 percent recorded the previous week.

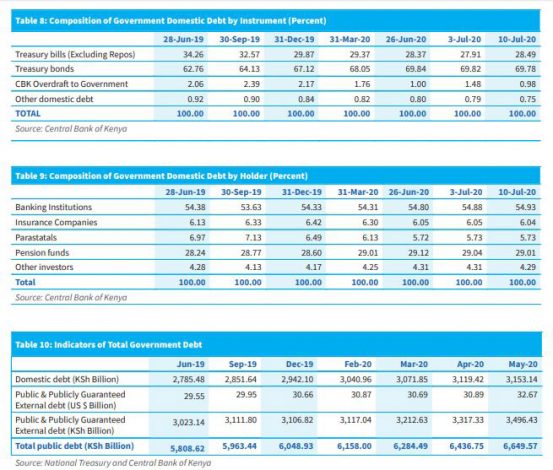

“We note that banks continue to prefer government securities as opposed to lending, with their holdings in Government domestic debt rising to 54.9 percent from 54.1 percent as at the start of the year,” observes Cytonn Investments Analysts.

Data from the CBK Weekly Bulletin shows that commercial banks are the biggest holders of Government domestic debt instruments at 54.93 percent, followed by pension funds at 29.01 percent. Insurance companies hold 6.04 percent of Government domestic debt, parastatals ( 5.73%) while other investors hold 4.29 percent.

Consequently, the interest rate on the 91-day paper fell to 6.01 percent from 6.27 percent in the previous auction, while that of the 182-day paper declined to 6.52 percent from 6.76 percent previously.

The 364-day paper, the rate stood at 7.46 percent, down from 7.7 percent in the previous auction.

“Given the low-interest rates, we, therefore, expect the focus to now shift towards unlocking the lending channels. This may see more efforts towards the activation of the Credit Guarantee Scheme in conjunction with the National Treasury. In the Budget, the government earmarked KES 3.00 billion for this project,” notes NCBA Research in their Monthly Economic Report published July.

READ

Further, NCBA found out that on the monetary side, while there is scope for further easing, the central bank will likely hold off any further easing.

“Inflation pressures are muted, thanks to reduced demand as well as food and fuel price pressures. CPI dropped to 4.6 percent in June from 5.3 percent in May and is projected to remain around the 5.0 percent medium-term target. Although the focus has shifted to reducing keeping output as close to potential as possible, the current torrents of liquidity landscape do not support further easing.”

“That said, how well the sector rides this tide remains subject to the unknown duration of COVID-19 and how quickly the economy finds its footing. For sure, banks will continue to play safe, by sustaining high liquidity levels, crucial for confidence in the current landscape.”

The government is currently in the market for KSh60 billion through a Treasury bond. The sale closes Tuesday.

In the current budget, FY2020/21, the government intends to borrow Kshs 569.4 billion comprising of Kshs 247.3 billion from external lenders, a 30.0 percent decline from the Kshs 353.5 billion seen in FY2019/20 and Kshs 318.9 billion as domestic debt from the projected 300.7 billion in the FY’2019/2020.

Consequently, the ratio of domestic to foreign debt will come in at 56:44.

Rating companies have already sounded the alarm on Kenya’s worsening finances. Moody’s Credit Agency, Standard and Poor’s (S&P) and Fitch Ratings have both revised their outlook from stable to negative.