This content has been archived. It may no longer be relevant

The Kenyan insurance industry is witnessing a remarkable transformation in the wake of the Covid-19 pandemic. There is no doubt that the pandemic will have widespread and long-term implications.

As cases continue to rise nationwide, most insurers will be forced to use technology-driven methods to reduce physical human interaction in order to provide seamless digital experience to their customers,” says Ms Bente Krogmann, the CEO and co-founder of mTek Services.

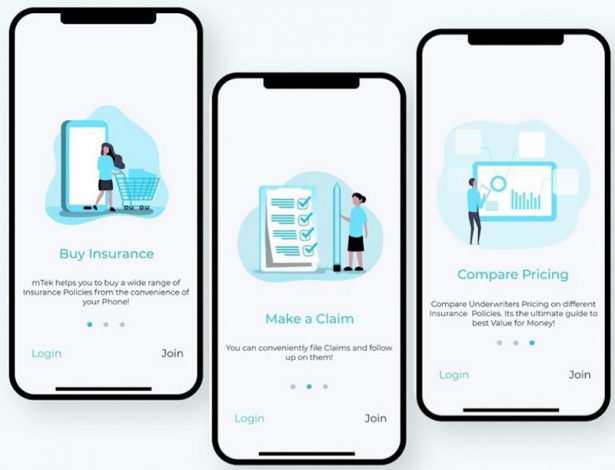

mTek is a digital insurance brokerage firm that distributes insurance policies from different underwriters locally via a mobile app. mTek provides an entirely end-to-end platform for the insurance industry.

Customers can download the app from Google’s Playstore, compare the policies available from different underwriters, and settle for the one that fits their needs.

“They can buy, process and settle claims entirely on the app,” offers the executive. She further says that with the availability of new technologies like mTek’s platform, the real task is to identify relevant tech partner that can deliver maximum value in a business environment.

“This is being driven by millennials who are early adopters of technology and prefer to transact via digital modes be it accessing the information on their policies or purchasing a product.”

Policies available in the app include motor, personal accident, fire, education, local and international travel, medication and evacuation.

Since its launch in late 2019, the firm has partnered with AAR, GA Insurance, ICEA Lion, Britam, AIG, Resolution and Madison.

Commenting on its inception, Ms Bente said, “We envisioned a solution that can speed up the time to market products, reduce the cost of delivery and unlock markets which were previously perceived to be unviable.”

Local underwriters have often been tipped to adopt insurance-focused technology known as ‘Insuretech’ to increase the coverage of Insurance from the current 3 percent.

“Technical and technology innovations are driving the growth and evolution of the insurance sector globally. The Internet of Things (IoT) advanced analytics, block-chain, artificial intelligence (AI), digital platforms and big data are providing new ways to price and manage risk, engage with customers, improve efficiency, reduce cost and provide effective insurance solutions,” Ms. Bente told Khusoko.

READ