This content has been archived. It may no longer be relevant

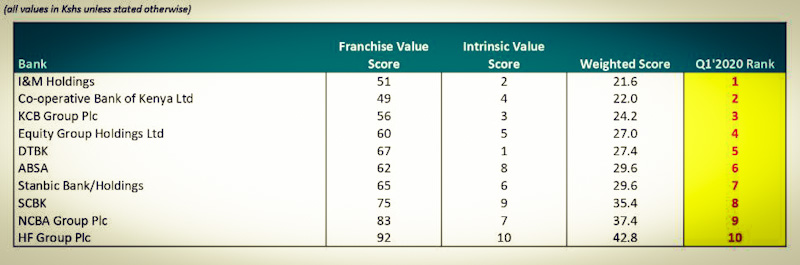

Banking group I & M Holdings is the most attractive listed bank in Kenya supported by a strong franchise value and intrinsic value score, according to the latest Q1’2020 report by asset manager Cytonn Investments.

Accordion to the report themed, “Deteriorating Asset Quality amid the COVID-19 Operating Environment,” I&M Holdings took the top position for having a better capacity to generate profits from its core business, Diamond Trust Bank Kenya took the top position from a future growth opportunity perspective.

However, DTB had a weak franchise score moving it to position 5 on the weighted score, and, Housing Finance came in 10th position on the back of weak franchise rankings scores as well as a non-promising future growth opportunity perspective as a result of lack of proper cost-efficiency structure.

Co-operative Bank of Kenya emerged top in the franchise ranking due to high-efficiency levels as evidenced by a low Cost to Income ratio which came in at 58.1 percent vs an industry average of 61.4 percent.

The franchise score measures the broad and comprehensive business strength of a bank across 13 different metrics, while the intrinsic score measures the investment return potential.

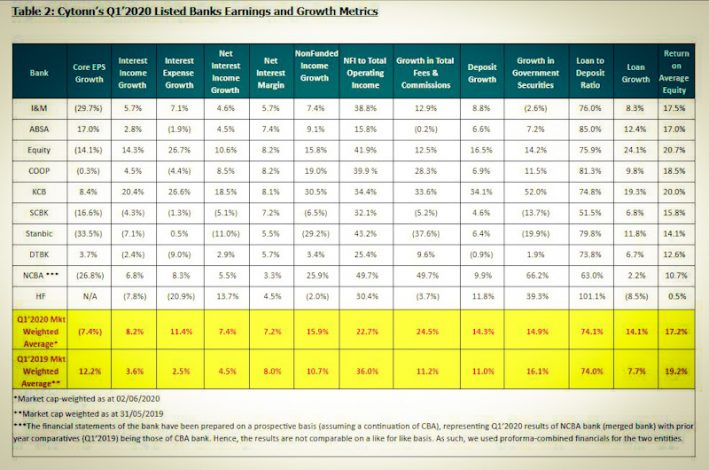

The report found out that asset quality deteriorated in Q1’2020 with the Gross Non Performing Loans (NPL) ratio increasing by 0.9 percentage points to 11.3 percent from 10.4 percent in Q1’2019.

“This was high compared to the 5-year average of 8.5 percent. In accordance with IFRS 9, banks are expected to provide both for the incurred and expected credit losses. Consequently, this saw the NPL coverage increase to 57.4 percent in Q1’2020 from 54.5% in Q1’2019 as banks adopted a cautious stance on the back of the expected impact of the COVID-19 pandemic,” said David Gitau, Investment Analyst at Cytonn Investments.

Four key drivers shaped the Banking sector in Q1’2020, namely Regulation, Consolidation, Asset Quality, and Capital Conservation.