This content has been archived. It may no longer be relevant

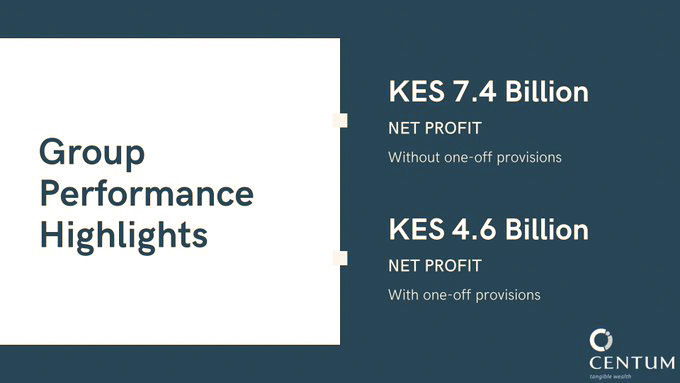

East Africa’s investment firm Centum recorded KSh7.4 billion after-tax profit for the year ended March 2020, a 79 percent jump earnings attributed to rising investment income.

“We are coming into this with quite a bit of liquidity,” said chief executive James Mworia.

Its net profit hit Ksh. 4.6 billion on significant gains from the disposal of its holdings in Nairobi Bottlers and Almasi Beverages in 2019.

The firms’ Total income increased 33.74 percent to KSh15.86 billion in the year ended March 31, in line with its Centum 4.0’ strategy.

Centum on June 8th, 2020 said it had fully repaid an outstanding amount of KSh6.6 Billion on its five-year corporate public bond, while in September 2019 the company paid off KSh7.8 Billion of a US Dollar-denominated debt.

“This deleveraging will save KSh1.8 billion in annual finance costs, which will further enhance the Company’s future performance and dividend payout,” said Dr. Mworia.

According to Mworia, the disposal of its equity stakes in Almasi Beverages Limited, Nairobi Bottlers Limited, and King Beverage Limited respectively, realised a net gain of KSh12.6 billion.

“The Almasi Beverages and Nairobi Bottlers sales achieved a combined average Internal Rate of Return (IRR) of 31 percent over the last ten years, demonstrating our track record in growing shareholder wealth through an optimal investment strategy, active portfolio management, and successful exits,” said Mworia.

Centum recommended a dividend per share of 1.20 shillings, unchanged from the previous year amounting to Ksh 798 million.

“We have retained the dividend policy to pay the higher dividend from the last year or 30 percent of annuity income. We think this is a good dividend and we will be enhancing this payout as we will not be carrying liabilities on debt servicing going forward,” said Mworia.