This content has been archived. It may no longer be relevant

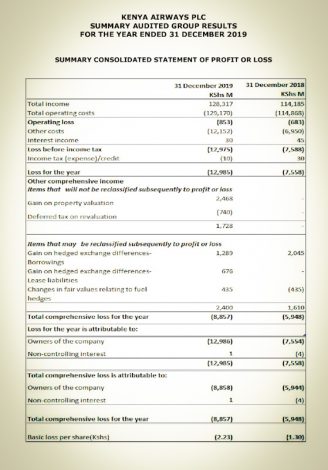

National carrier Kenya Airways sank deeper into losses for the full year that ended in December 2019, hurt by fuel, personnel, and aircraft costs.

“The Group saw a 12.4 percent increase in operating costs, driven by the increase in capacity deployed and an increase in fleet ownership costs attributed to the return of two Boeing 787 aircraft that had been subleased to Oman Air,” chairman Mr Michael Joseph said in a statement.

Further, the adoption of new IFRS 16 rules in 2019/ required significant adjustments to both the profit and loss statement and balance sheets of the financial year.

However, the airline’s revenue increased by 12.4 percent from Ksh 114, 185 in 2018 to KSh128.31 billion due to improved passenger, cargo as a result of its expanded network.

“In the year under review, the Airline invested in new routes to the network; Geneva, Rome, and Malindi. This expansion resulted to a 6.7 percent increase in passenger numbers to hit a record 5.1 million passengers,” Mr Joseph said.

Consequently, it made a request to the Treasury for KSh7 billion emergency bailout for the maintenance of the grounded planes and payment of staff salaries.

However, Business Daily Africa quoting Treasury Cabinet secretary Ukur Yatani says that the government is focused on nationalising the carrier as a long term solution for KQ.

“We are not making any commitments at this stage. Kenya Airways need to remain afloat but it is also important to look at structural challenges because what is happening now is more than the business environment,” said Yatani.

READ