This content has been archived. It may no longer be relevant

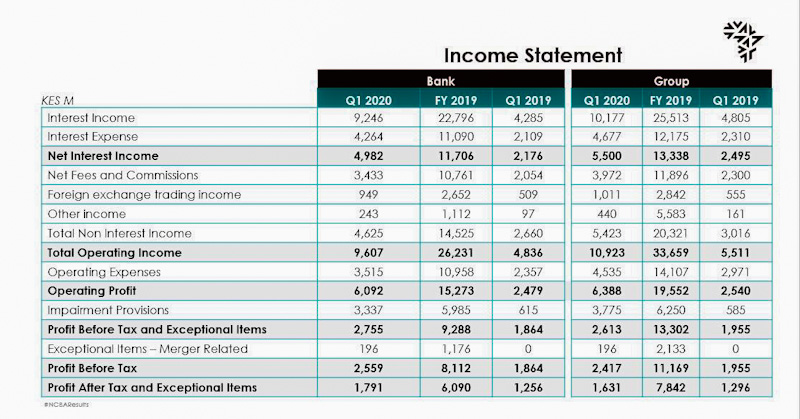

Kenya’s fourth-largest bank by assets, NCBA Group Plc, Wednesday posted a pre-tax profit of Ksh2.4 billion for the quarter ending March 31, 2020.

Total operating income for the quarter was Ksh 10.9 billion and profit after tax was Ksh 1.6 billion.

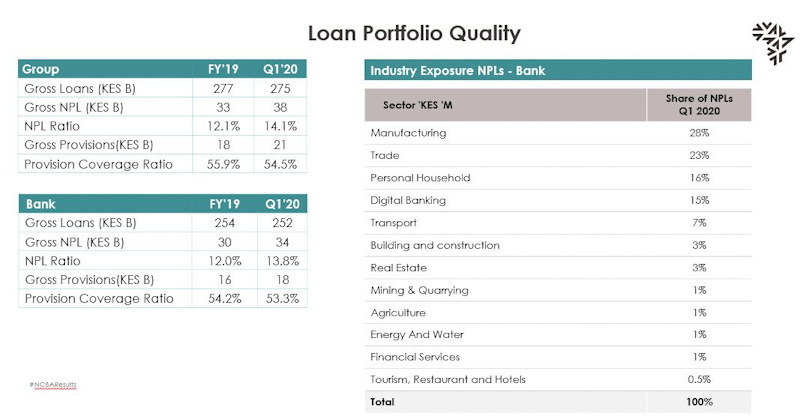

However, the Group’s non-performing loans increased especially in the transport and manufacturing sectors, and on the mobile loan portfolio and has taken proactive steps to increase provisions coverage through an increase in its impairment provisions.

“NPLs remain a major issue from legacy accounts for which we continue to provide. Further stress was seen in the digital business as a result of a one-off increase in limits. We expect that the impairments seen in the digital business will normalize during the second quarter.

However, we expect the overall NPL ratio will continue to be impacted negatively by the ongoing challenges in the market caused by the pandemic,” said NCBA Group Managing Director, John Gachora.

The customer base stood at 54 million, deposits stood at Ksh 390.5 billion, while the net loan book closed at Ksh 245.9 billion.

According to the lender, the consolidated financial statements are also a continuation of the financial statements of CBA with an adjustment to capital to reflect the legal capital of NIC. The prior year comparatives are those of CBA.

Mr Gachora noted the Bank has led the way in taking capital conservation measures including replacing an earlier proposed cash dividend with a bonus share issuance for the financial year 2019.

In April, the board attributed the changed decision to the COVID-19 pandemic’s “devastating effects to the world and the Kenyan economy”.

“NCBA’s Q1 results will be a reflection of the Kenyan banking sector where asset quality will deteriorate and negatively impact provisioning and overall operating expenses,” commented Renaldo D’Souza, Head of Research at Sterling Capital Limited.

“With regards to investment strategy, banks will shy away from private sector lending in favour of lending to other banks in the inter-bank market and investment in Government securities. The overall impact on the banking sector will be subdued profitability growth in what is proving to be the challenging operating year 2020.”

1 Comment

Pingback: NCBA Group Back in the Black, Net Profit Rises to Ksh 2.84 bn in Q1