This content has been archived. It may no longer be relevant

Nairobi Securities Exchange Derivatives Market (NEXT) performed relatively well with 302 contracts traded in the Quarter ended March 2020.

Data from the Capital Markets Authority (CMA) Quarterly Statistical Bulletin said the performance reflected a 47.32 percent an increase of over 205 contracts traded in the fourth quarter of 2019.

During the period, “KCB Group Futures was the most liquid with 138 contracts, followed by Safaricom with 47 contracts.

Other contracts traded included Equity Bank, Absa Bank, British American Tobacco, and the NSE 25-Share index Futures,” Mr.Luke Ombara, CMA Director, Regulatory Policy and Strategy.

The NEXT derivatives market is expected to provide new opportunities to investors enabling them to diversify, manage risk and allocate capital efficiently.

Market capitalisation drop 25.9 percent with KSh170b lost

During the period under review, investors at the bourse lost KSh170 billion in paper wealth with market capitalisation dropping by 25.9 percent from KSh2.2 trillion on December 31, 2019, to KSh2.02 trillion in March 31, mainly on account of the coronavirus pandemic.

According to the regulator, the NSE-20 Share Index dropped by 20.7 percent.

Ombara noted that despite the drop, timely fiscal and monetary policy interventions by the government and financial sector, there will be stability.

“The government, the Central Bank of Kenya and the CMA have continued to provide short-term guidance which has had a positive impact on important ‘macro-economic indicators,” said Ombara.

Equity turnover declined marginally to KSh43.7 billion compared to KSh45.01 billion registered in quarter four of 2019. Volume of shares traded rose by 5.5 per cent to 1.36 billion.

Unit Trust Funds

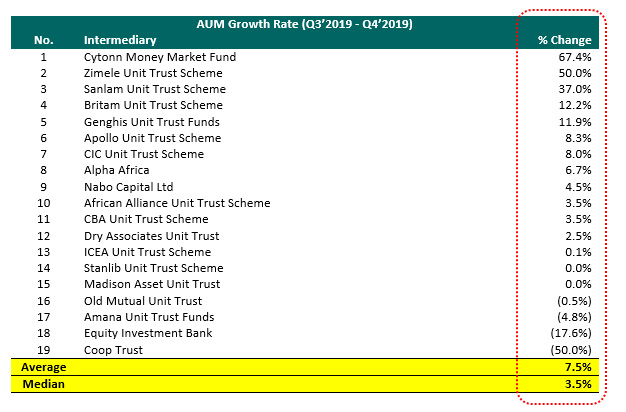

Further, the Cytonn Money Market Fund was the fastest-growing unit trust scheme topping the list of the 19 approved active Collective Investment Schemes in terms of Assets Under Management (AUM) growth according to the report.

CMMF recorded AUM growth of 67.4percent, from an AUM of Kshs 430 million in Q3’2019 to Ksh 720 million in Q4’2019. Zimele Unit Trust Scheme had the second-highest growth of 50.0 percent, with Sanlam Unit Trust Scheme with the third highest growth at 37.0 percent.

According to the report, CIC Unit Trust Scheme managed the highest AUM of Kshs. 29.7 billion as of December 2019, which was 39.0 percent of the total AUM. 52.1 percent of AUM under all Collective Investment Schemes are invested in Government Securities as at 31st December 2019.

Bond Market turnover

Bond Market turnover at Nairobi Securities Exchange for the quarter stood at KSh. 157.98 Billion, compared to KSh. 158.07 Billion registered in Q1.2019 registering a 0.06% decrease.

Safaricom remained the most capitalised at an average of KSh 1,132.52 at close of Q1, 2020 followed by Equity Group KSh 162.52 billion, East African Breweries KSh 147.08 billion, KCB KSh 141.41 billion, Co-operative Bank KSh 81.45 billion, Stanchart KSh 66.01 billion, Absa Bank KSh 65.36 billion, NCBA KSh 48.73 billion, British American Tobacco KSh 44.60 billion and I&M Holdings KSh 42.93 billion.

Banks, Safaricom Stocks Rally Should Continue in 2020 – Analysts

***

“Outlook for the quarter is stable buoyed by a mix of risk management interventions being undertaken to mitigate against identified exposures; good corporate results in selected counters; opportunities for diversification of portfolios across asset classes such as the Absa Gold ETFs, Real Estate Investment Trusts (REITs) based on long-term investment horizons, capital preservation strategies and renewed appetite for Treasury bonds.”

However, the performance will depend on how the Government uses its fiscal and monetary tools to cushion the most vulnerable businesses and individuals, especially the low-income earners and boost investor confidence.