This content has been archived. It may no longer be relevant

Equity Group Holdings on Tuesday posted an 11% pretax profit of Ksh 24.78 billion shillings attributed to a rise in interest and non-funded income in Kenya.

The Group’s net interest income grew by 10% to Kshs 32.29 Billion from Kshs 29.47 Billion.

Non funded income grew by 14% to Kshs. 22.54 Billion up from Kshs. 19.83 Billion to lift total income by 11% to Kshs 54.83 Billion up from Kshs. 49.3 Billion.

“The faster growth in total income above net interest income reflects success of the strategic pursuit of the Group to grow quality income through non funded income growth,” Chief Executive James Mwangi told investors.

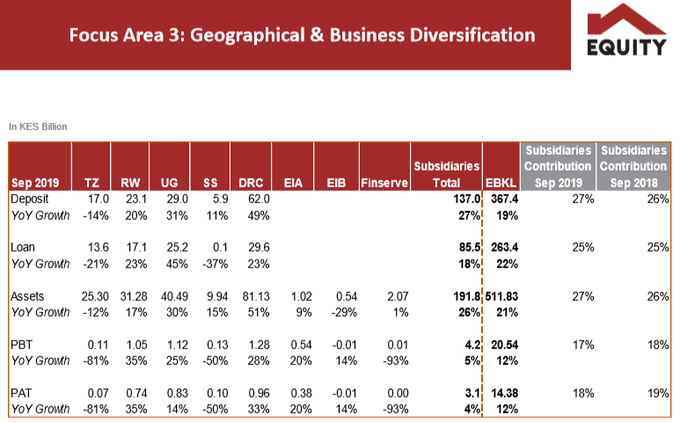

The Group’s balance sheet grew by 21% to Kshs. 677 Billion up from Kshs 560.4 Billion driven mainly by 21% growth in net loans and 40% growth in cash and cash equivalent.

“The 21% growth in the balance sheet was driven by customer deposits growth of 19% and the ability to deploy such growth in funding to a quality asset portfolio, and a liquidity of 54.2% reflects the strong strategic positioning of the Group and its ability to effectively manage portfolio risk following the removal of interest rate capping in the Kenyan market that hold 75.6% of the loan book.”

The group, which also operates in Tanzania, Rwanda, Burundi, South Sudan, Uganda and the Democratic Republic of Congo, posted a pretax profit of Ksh 22.41 billion last year, up 8% from Ksh 20.7 billion shillings in the first nine months of 2017.