This content has been archived. It may no longer be relevant

Investors seeking to finance new hotel projects in Africa are more successful if the project is a mixed-use development.

This is according to Jones Lang LaSalle (JLL), a real estate management services firm, Q4’2019 Spotlight on Africa Report, which attributes the trend to their rental model which is in Euros and US dollars rather than local currency.

The report says this kind of payment reduces the risk to the lender and lowers the interest rate paid by the borrowers.

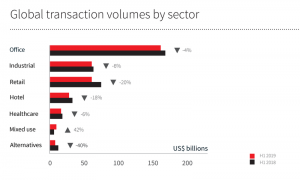

From the JLL’s research findings into global property transactions revealed that in the first half of 2019, there was a 42% increase in the value of mixed-use property transactions.

However, there was a decline in other sectors, with Office down 4%, Industrial down 6%, Retail down 20%, Hotel down 18% and alternatives down 40%.

Xander Nijnens, Executive Vice President, JLL Sub-Saharan Africa, explained that, “Diversifying risk by including alternative types of property, commercial, retail, hotel and branded residences, in one development, provides comfort to financiers due to the diverse and more consistent income streams generated.”

“Branded residences are also increasing in prevalence because they provide up-front cash inflows and a more predictable source of revenue than one gets from a hotel alone,” He added.

In Africa, the leading funders of hospitality construction projects are government-backed Development Finance Institutions (DFIs) like International Finance Corporation (IFC), Overseas Private Investment Corporation (OPIC), the CDC Group, Proparco and the German Investment Corporation (DEG).

According to Cytonn Investment, Investors are likely to be attracted to mixed-use developments due to their enhanced performance which is driven by:

Operational Synergies – The various themes in a mixed-use development complement each other. For instance, building residents will create a ready market for retail services while firms occupying office space are potential clients for hotel, restaurant and conferencing space in the hotel. As a result, improvement of the performance of one theme leads to better performance in other themes,

Risk Diversification – Having multiple components in the development creates multiple revenue streams that help to diversify the risk of a project. In case uptake for one of the themes is low, the developer or property manager will continue to receive revenues from the other themes. The developer can also opt to alter uses, depending on each theme’s performance; for example, underperforming residential units can be serviced or furnished apartments, and vice versa, and,

Potential for Higher Occupancies – MUD’s create an environment where occupants can live, work, play and invest all in one location, hence reducing time and cost incurred while commuting. By creating convenience, therefore, MUD’s attract demand from both prospective homeowners and corporations.