Shares of listed banks in Kenya have been assigned a recommendation of “Hold” from investment firm Genghis Capital.

“We note that the challenging business environment, occasioned by regulatory constraints, coupled with weakened asset quality, serve as impediments to growth. There still exists uncertainty with the interest rate cap ceiling,” according to the firm’s 2019 Banking Sector Report.

However, the firm has reservations on KCB Group Plc, Standard Chartered Bank Kenya Ltd, and Diamond Trust Bank Kenya Plc.

They recommend a buy on DTB Kenya with a Target Price of KES 149.80, a 17.5% potential upside from the current market price and on KCB Group with a Target Price of KES 62.52, a 39.6% potential upside from the current market price.

They recommend a sell on Standard Chartered Bank of Kenya with a Target Price of KES 193.88, an 8.5% potential downside from the current market price. “We are of the opinion that the bank’s conservative strategy will continue to curtail growth, with FY19F bottom-line performance expected to decline (-6.3%PAT). Further, we remain concerned about the asset quality, noting that the NPL ratio remains the highest in our sector coverage, which despite the expected improvement, may not result in major deceleration in the ratio.”

The rest of the listed banks -Stanbic, National Bank of Kenya, Housing Finance, I&M, Co-op Bank, Barclays Bank Kenya, Equity Group and NIC Bank – have been recommended a hold because their stock’s total return* is expected to be in the range of -15% to +14% over the next 12 months from the date of report publication.

Those on Buy, the stock’s total return* is expected to be more than 15% (or more, depending on the perceived risk) over the next 12 months from date of report publication and those on Sell (S) the stock’s total return* is expected to be less than -15% over the next 12 months from the date of report publication.

On the other hand, Cytonn Investments in their Kenya Listed Commercial Banks Analysis Cytonn FY’2018 Banking Sector Report, the sector witnessed growth despite the tough operating environment, characterized by the tighter regulated environment, following the capping of interest rates and compliance to the IFRS 9 standard. Increased usage of alternative channels improves operational efficiency as well as expanding Non-Funded Income.

However, both Cytonn Investments and Genghis Capital observe the continuous “Deteriorating asset quality remains a concern, which has seen banks reduce lending to the riskier private sector and channel more funds to government securities.”

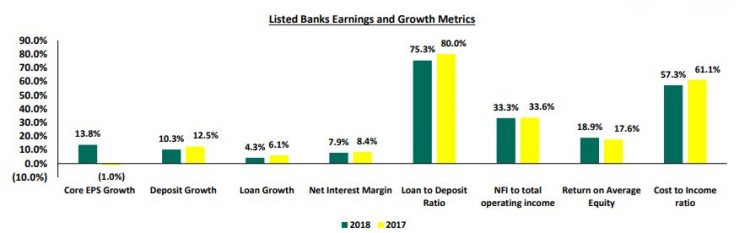

In the report, Kenya’s listed banking sector FY’2018 core Earnings Per Share (EPS) increased by 13.8% compared to a decline of 9.3% in FY’2017, and consequently, the Return on Average Equity improved to 19.0% from 17.6% in FY’2017.