A majority Kenyans prefer to be served by a teller as opposed to using automated services at their local bank according to the Kenya Bankers Association (KBA) survey.

KBA’s “Survey: Customers Not Ready for Robotic Agents But Value Mobile Banking” found out that eight in ten Kenyans prefer consulting a human being rather than robots, chat-bots and other Artificial Intelligence models of customer service.

“Bank customers in Kenya have not yet warmed up to the idea of robots and artificial intelligence and would rather have humans handle their customer service needs,” said KBA Director of Communications and Public Affairs Nuru Mugambi during the report’s launch.

“However, further research is needed to establish whether this trend owes to low levels of awareness about the value proportion of chat-bots, robots, and other emerging data-driven Artificial Intelligence technologies,” the survey says.

The Kenya Bankers Association key findings:

- 49 percent of respondents preferred mobile banking channels

- 80 percent of customers still value the traditional human model of customer service

- 89 percent of respondents said they had a better service experience in 2018

Read: Services banks must offer to survive in the era of digital savvy customers

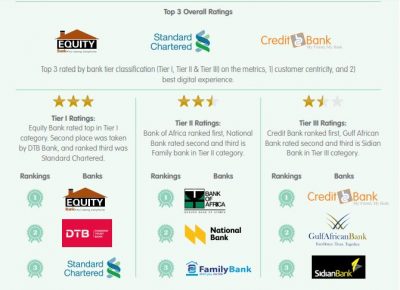

Bank Size is Immaterial in Customer Centricity

To access customer centricity, the respondents were asked “Which bank do you feel does a good job with customer service in general?”, “Which bank has the best digital user experience?” and “Which bank is most responsive to the issues you have raised?”

A huge percentage of the respondents rated the customer experience, responsiveness of the bank to the customer needs and the best digital experience of Equity Bank, the Standard Chartered Bank and the Credit Bank as the highest in the market, “an indication that customer centricity and satisfaction are important to customers irrespective of the size of the institution.”

While Equity Bank and the Standard Chartered Bank are Tier I banks, the Credit Bank is a Tier III bank. This means that even banks like the Bank of Africa, the Family Bank and the National Bank, which are all Tier II but did not feature in the top 3, can borrow a leaf or two from Credit Bank when it comes to customer experience.

Bank Services Improved Service Delivery in 2018

While the respondents noted that there is much to be done to improve their customer experience, 89 percent of them also acknowledged that they had received improved service experience in 2018. This is up by 23% compared to 66% of respondents who had acknowledged improved service in 2017.

“During this year (2018), how do you think banks have performed in the area of customer service — compared to last year (2017)?” and “Do you think banks are making an effort to improve their customer service standards?” respectively.

The positive improvement can be an indication that a “customer-centric approach has been entrenched by the industry” the survey findings say.

- Customers Prefer Mobile Banking Channels

When the respondents were asked, “What is your preferred bank channel?” 49% of them preferred mobile baking, while 16% of the respondents preferred internet banking, with 5% of them were inclined to ATM transactions. An interesting observation is that a huge fraction of those who prefer utilizing digital banking are those between 26-25 years of age.

However, KBA still needs to ascertain if customers particularly prefer digital banking channels for checking their account balances and transfer of funds, as well as complaint handling since human channels were found to be preferred for banking services such as complaints.

- Customer Complaint Mechanisms

To the question “Which is the best way for banks to handle customer complaints?” most respondents ascertained that they prefer contact centers as a touch point. This response dominated no matter the age cohort, which were 19-25 years, 26-35 years, 26-45 years, 46-55 years and 56 -70 years.

Surprisingly, the second most preferred channel is email correspondence, more than in branch service. Email correspondence had a higher prevalence among the elderly, especially those in the 56-70 years age bracket.

The KBA advises banks to factor in demographic preferences when it comes to bank complaint handling and mitigation strategies.

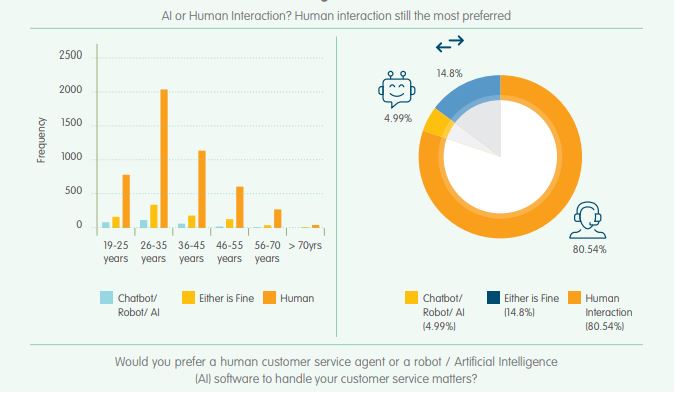

- Artificial Intelligence Vs. Customer Service Agents

It turns out that even with the phenomenal artificial intelligence advancements in recent years, “human interaction is the most preferred model, based on the survey responses” the survey report says. 80.54% of the respondents confirmed that they prefer human interaction when the question “ Would you prefer a human customer service agent or a robot / artificial intelligence (AI) software to handle your customer service matters?” was posed.

The KBA speculates that the preference “could be attributed to the fact that the banking public is accustomed to the traditional human model, which is based on building relationships with customers…However, further research is needed to establish whether this trend owes to low levels of awareness about the value proposition of chatbots, robots and other emerging data-driven Artificial Intelligence technologies.”

- Verbatim Responses on “How would you like the Kenya Bankers Association to help improve customer service standards?”

Out of the 5,088 verbatim responses received, there was a general consensus among the respondents that the banking sector needs to enhance service delivery by training staff who interact with customers and leveraging on digital channels, particularly mobile banking, to better the user experience. This is to particularly address the particular pain point for banking customers that is the speed of service and expeditious complaint resolution.

The survey was administered by KBA and conducted by the Institute of Customer Service Week during the last quarter of 2018. This was in conjunction with the 2018 Customer Service Week. The survey ran from the 23rd of September 2018 to the 13th of November 2018 and the results which were released are based on feedback from 6,121 random respondents.