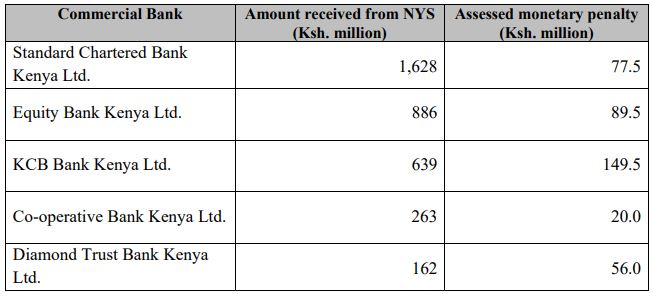

The Central Bank of Kenya has fined five big banks Ksh 392.5 million for transacting illegally with the National Youth Service (NYS).

“CBK announces the conclusion of the first phase of the investigation of the banks that were used by these persons in transacting the NYS funds. The investigations prioritised banks that handled the largest flows, namely; Standard Chartered Bank Kenya Ltd, Equity Bank Kenya Ltd, KCB Bank Kenya Ltd, Co-operative Bank of Kenya Ltd, and Diamond Trust Bank Kenya Ltd,” said the regulator said in a statement issued on Tuesday.

“The actions taken by CBK and subsequently by other agencies are aimed at safeguarding stakeholders’ interests and maintaining a healthy financial sector,” added the CBK.

Central Bank says it had assessed monetary penalties for each of the five banks in accordance with the extent of the violations that were identified and pursuant to CBK’s powers under the Banking Act and the Central Bank of Kenya Act.

The regulator examined the operations of the NYS-related bank accounts and transactions, and in each instance assess the bank’s compliance with the requirements of Kenya’s Anti-Money Laundering/Combating Financing of Terrorism (AML/CFT) laws and regulations.

The findings state that the accused banks were in violation of failure to report large cash transactions, failure to undertake adequate customer due diligence, lack of supporting documentation for large transactions, and lapses in the reporting of Suspicious Transaction Reports (STRs) to the Financial Reporting Centre (FRC).

Equity Bank confirmed having received the report of the Central Bank of Kenya June 2018 inspection report targeted at the National Youth Service banking transactions for the period 2015 to 2018 at a meeting held with the Central Bank of Kenya on 10th September 2018.

“The bank is currently reviewing the report with a view to providing a detailed response to the issues raised by the Central Bank of Kenya within the stipulated period,” said the bank in a statement.

KCB Bank said “KCB Bank remains committed to the respective banking laws across our markets of operation,” the lender said.

The regulator says the second phase of the investigations will involve the use of ‘these findings by other investigators, inter alia, assessment of criminal culpability by the Directorate of Criminal Investigations (DCI) and the Office of the Director of Public Prosecution (ODPP)’.

“CBK has shared the findings with the relevant investigative agencies for their appropriate action. Further, an additional set of banks will also be identified and investigated,” said the CBK.