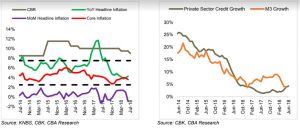

The Kenya Central Bank cut its lending rate to 9.0 from 9.50 percent extending the easing cycle. This is the second rate cut this year in support of economic activity.

In a statement, the CBK said policymakers felt:

“Inflation expectations were well anchored within the target range, and that economic growth prospects were improving. Furthermore, economic output was below its potential level, and there was some room for further accommodative monetary policy. Consequently, while noting the risk of perverse outcomes, the Committee decided to lower the Central Bank Rate (CBR) to 9.00 percent from 9.50 percent.”

“The decision to cut rates seems to be underpinned by a stable inflation outlook,” noted Analysts from the Commercial Bank of Africa (CBA).

According to the MPC, the increase in consumer prices is expected to remain within the 2.5-7.5 percent target band, although risks could stem from recent tax proposals that could affect the CPI.

“The signal from the MPC could support further downward pressure on the yield curve although the impact may be somewhat diluted by the expected increase in inflation. Meanwhile, subdued need for funds, pending the approval of the Finance Bill and ongoing procurement and financial audit, could keep rates contained,” CBA Analysts add.

On the other hand, ahead of the MPC meeting that was held on Monday, Genghis Capital had noted that despite the key macroeconomic indicators pointing towards monetary easing, the MPC was expected to maintain the CBR at 9.5 percent… “As the interest rate caps pose a threat to growth.”

Read:

- Rate caps have delivered perverse outcomes of Monetary Policy – CBK

- Why Restoring Credit Growth is Key to Kenya’s Economic Recovery

“The key concern for the committee should lie in the weak Private Sector Credit Growth (PSCG), which continues to remain subdued. While a rate cut would be ideal to arrest the low PSCG.”

However, after the cut, Genghis Capital notes, “The monetary easing stance may well be as a result of the MPC pre-empting a repeal of the interest rate caps, which pose a threat to credit growth (and the economy at large) with continued rate cuts.”

Private sector credit grew by 4.3 percent in the 12 months to June 2018, compared to 2.8 percent in April 2018.

“Growth in private sector credit is expected to pick up gradually with the continued recovery of the economy,” said Dr. Patrick Njoroge.