Industrial gas manufacturer BOC Kenya Plc (BOC), has issued its second profit warning for the financial year ending on 31 December 2019 citing a number of factors impacting the East African gas supplier.

The leading supplier of industrial, medical and special gases in Kenya, Tanzania, and Uganda said on Wednesday that the performance for the financial year is set to drop by at least 25 percent.

It joins coffee grower Eaagads and Insurer UAP-Old Mutual who were the first listed companies to issue profit warnings.

Marion Mwangi, BOC Kenya’s Managing Director said this is attributed to the dismal performance to depressed demand for gases from the industrial sector due to the prevailing economic environment.

She further said various customer invoices have not been paid for months.

“Supply to several public sector customers with invoices that have remained unpaid for periods significantly above the allowed credit period. These overdue amounts have also led to additional doubtful debt provisions,” she said in a public notice.

The firm’s woes were also intensified to high local energy costs impacting their production costs and outage of key raw materials duet to constraints on the part of their overseas supplier.

“Together with unanticipated downtime of the gas production plant to undertake emergency repairs. These issues have been resolved,” she said.

In its half-year financial report ended in June, it reported a 66.8 percent drop in net profit to KSh19 million.

The Company’s core products are Oxygen, Nitrogen and Dissolved Acetylene (DA). Oxygen and nitrogen are sold either in liquid form or are packaged into cylinders. Gas sales in liquid form comprise medical oxygen sold to hospitals that have installed medical pipelines in their wards and other patient care areas, oxygen and nitrogen to industrial customers.

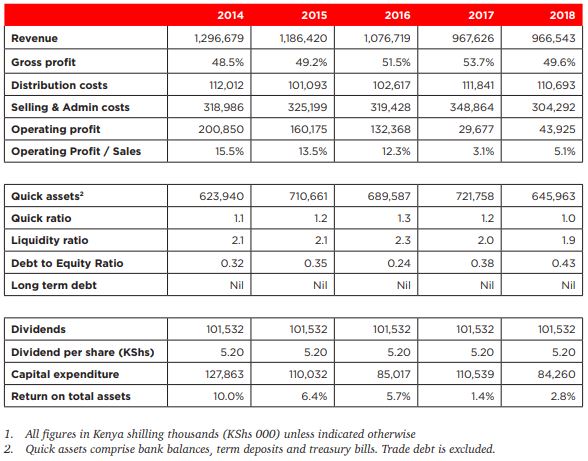

In its 2018 financial report, said its revenue has declined over the five-year period due to a variety of factors. “Rather than adjust prices upwards in tandem with inflation, the Company has had to concede lower prices due to an increasingly competitive landscape occasioned by the importation of cheaper products from other parts of the world in an increasingly liberal economic environment.”

During the five financial years from 2014 to 2018, the Company declared and paid dividends amounting to KShs 508.6 Million.

UAP Holdings Limited who also issued a profit warning citing depressed property prices and a tough environment in South Sudan.

“There are indications that the weakening performance of property market in Kenya and the uncertain political environment in South Sudan will likely lead to further impairments in the carrying value of certain group investment properties,” said the firm.

Eaagads attributed its anticipated decline in earnings to the depressive global coffee prices which have reduced significantly this year in the face of market oversupply.

“The drop in profitability was further exacerbated by an increase in coffee production costs, notably increased labour costs, which have been on an upward trend year over year,” noted the company’s board.

READ: